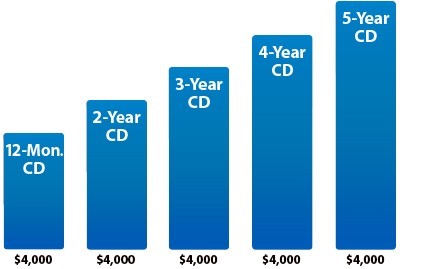

A CD Ladder can provide a savings strategy with both short- and long-term benefits. To better understand this simple savings approach, see the example below.

Where to start

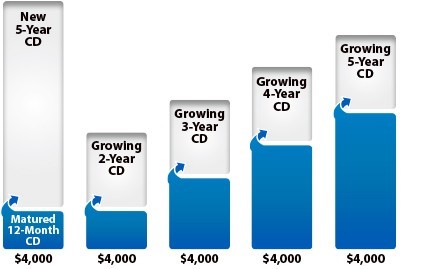

For this example, we will use a $20,000 initial investment and build a 5-year ladder. To begin, divide the money evenly over the 5 years, by opening 5 CDs with terms 12 months apart. This provides access to a portion of your funds every 12 months.After 12 months

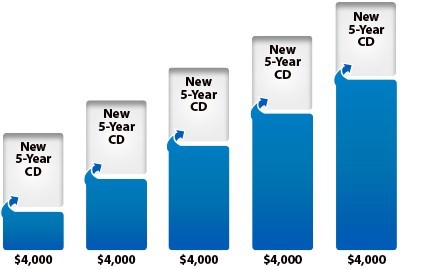

When your 12-month CD matures, you then may decide to ladder the investment by renewing it to a new 5-year CD. By renewing to the longest term, you will generally enjoy the highest rates available.